RWA stands for Real World Asset. It is a Web3 term used to describe physical or digital assets that have “real world” value off-chain which are placed on-chain. The first true real world asset was stablecoins as their value off-chain was applied to tokens like USDT and USDC on-chain. CBDCs are sovereign extensions of this original on-chain fiat thesis.

RWA Phase 2

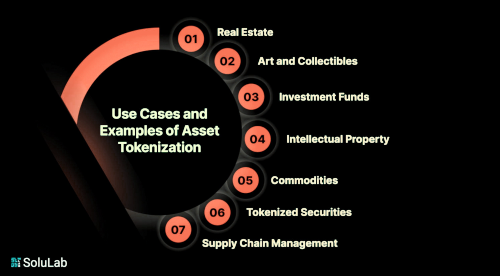

The second phase of these assets is in the form of legacy Tradfi assets such as IP, art, real-estate, commodities, and securities where their value is exchanged on-chain via tokens and associated services (like wallets and exchanges) that exist on or off-chain. The ability for an asset to exist on a blockchain has many benefits including:

- * Fractional ownership

- * Auditability

- * Portability

- * Liquidity &

- * Security

RWA and TAPs

On-chain financial service providers known as TAPs (Token Asset Providers) such as Tokeny and Securitize apply securities oriented process for the creation, use, and liquidation of real world tokenized assets on behalf of their customers which can be either Defi oriented or Tradfi oriented or both.

References:

https://www.rwa.xyz/

https://www.coingecko.com/en/categories/real-world-assets-rwa

https://www.coingecko.com/research/publications/rwa-report-2024

https://www.coindesk.com/learn/rwa-tokenization-what-does-it-mean-to-tokenize-real-world-assets/

« Back to Glossary Index