Mergers and acquisitions (M&A) are transactions in which the ownership of a company (or an operating unit) including all their associated assets and liabilities are transferred to an acquiring entity.

A merger is the consolidation of two entities into one and an acquisition is when one company takes over ownership of another. M&A enables organizations to grow (or downsize) and to adjust their competitive position. Technologies such as Regtech have helped streamline the process of moving these types of transactions forward. Over 90% of all successful technology startups exit via the M&A route compared to those that do an IPO. The interview below featuring serial entrepreneur and M&A growth expert Brad Jacobs is a deep dive into what defines a good (or bad) M&A transaction.

M&A Phases:

1. Discovery

M&A transactions typically have an initial due diligence task that includes a discovery phase. People and culture discovery is often done before or at the same time as technology discovery. The results gathered inform and influence the buyers purchase decision. If a company is looking to merge or be acquired they may also build a candidate short list doing the process.

2. Gap Analysis

M&A suitors often run a gap analysis. This process will compare the current state of their organization with the ideal state post deal – highlighting both shortcomings and opportunities for improvement. This analysis will make it easier to prepare a roadmap for implementation. For example – the video below stresses the value of technology, market landscape, and complex org charts in the buying process.

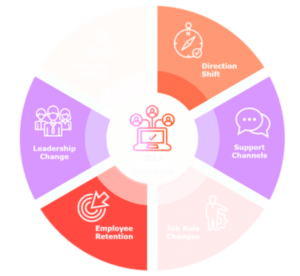

3. Communication

Once an M&A roadmap is in place and a transaction has closed, a communication/transition plan is often already in place for how the buyer will be communicating upcoming changes to those affected by the acquisition. Sending communication on multiple dates and through various channels planned in advance ensures that the information is reaching the intended audience.

4. Training

Much like communication, acquirers create a plan for incoming staff training. These training sessions increase staff awareness and subsequently they will be that much more prepared when they are asked to adjust to the new process and platform standards of the acquirer. Additionally, providing employees access to a Frequently Asked Questions (FAQ) list helps alleviate common issues as the transition begins to roll-out.

5. Champions

One of the most effective ways of increasing employee adoption is by implementing a Change Champion Program. In this program – select employees are asked to help increase staff buy-in and reduce resistance to changes associated with the M&A deal. Champions are expected to help ease the transition of corporate culture changes and technical changes among their fellow employees.

References:

https://www.ey.com/en_us/strategy-transactions/buy-integrate

https://www.investopedia.com/terms/m/mergersandacquisitions.asp

https://www.goldmansachs.com/what-we-do/investment-banking/mergers-and-acquisitions/index.html

https://www2.deloitte.com/us/en/pages/mergers-and-acquisitions/articles/m-a-trends-report.html