Our Why

“Every battle is won or lost before it is ever fought”

Sun Tzu

B.I.G.'s raison d'être

INTRO

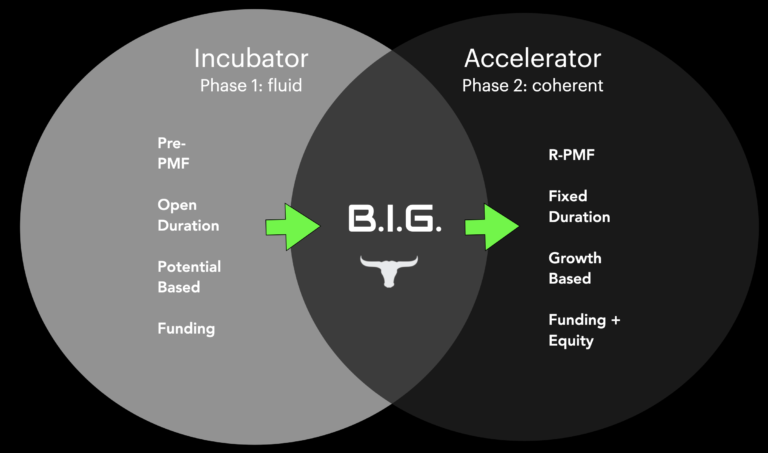

The BIG Idea Guild (B.I.G.) is a PMF leadership and capital sourcing platform for veteran B2B startup founders building game changing (i.e. inflection point) technology. As an IMA (Investor Master Agent) we do what neither incubators or accelerators do on their own – we create a consistent hands-on path for both PMF and sales very early on.

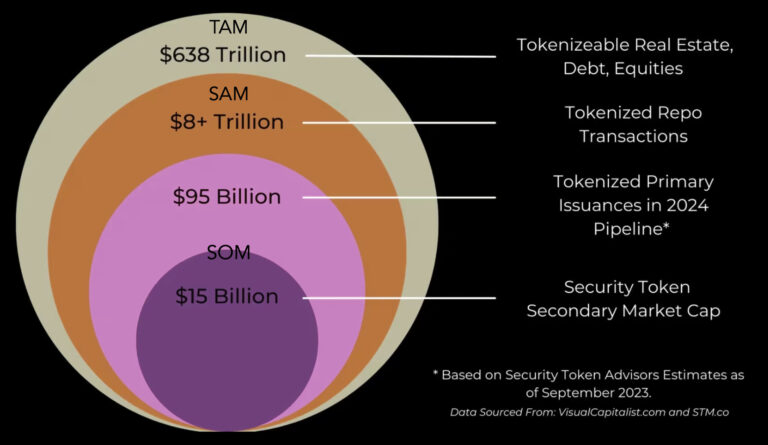

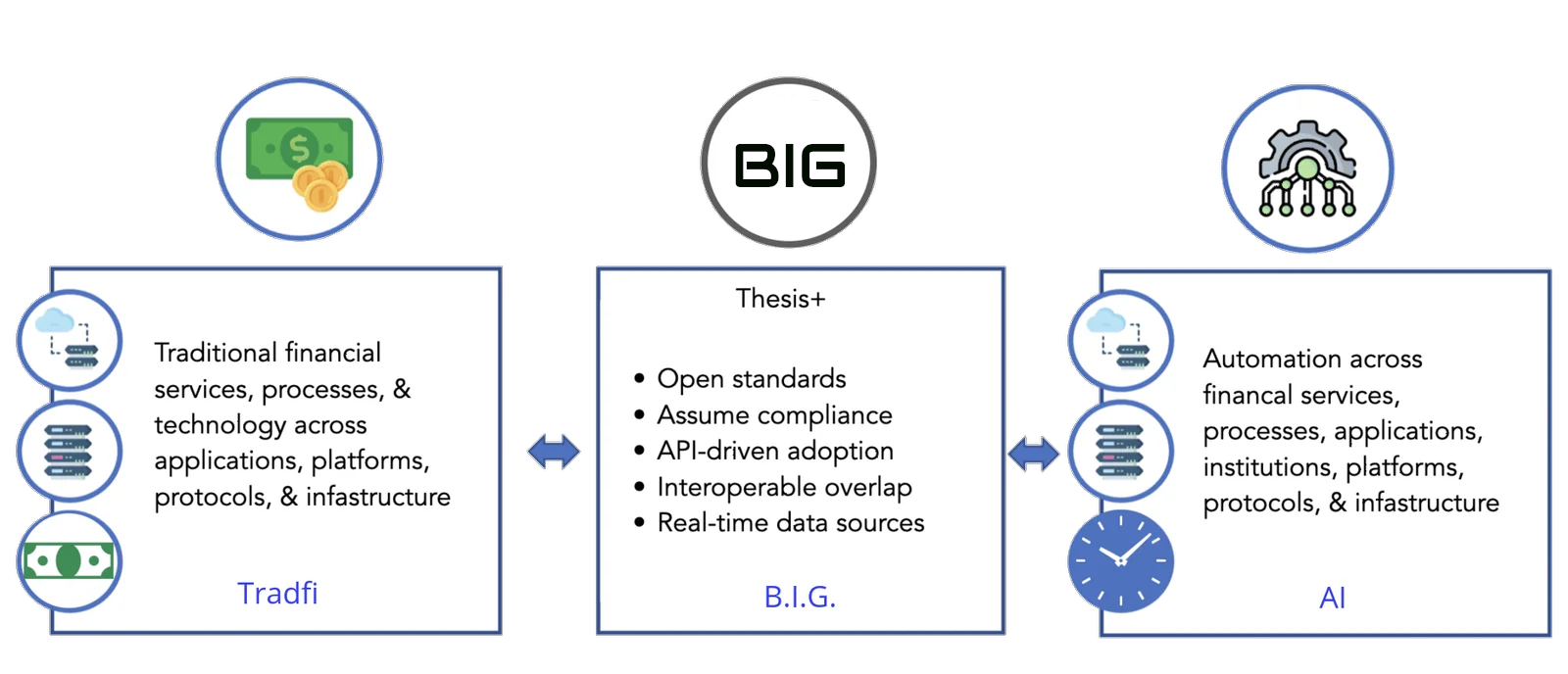

B.I.G. is also an investor hub for those looking to profit from the large markets we engage in – such Business Intelligence (BI), Dataops, and Traditional Finance (Tradfi) modernization. For example, Tradfi alone represents about $638Tn globally.

Post acceleration, B.I.G. becomes an early-stage investor building a complementary tech portfolio. We directly connect with early stage thesis driven investors looking for veteran SME founders with battle tested PMF potential. Our projects prove early stage adoption, prove a high market ceiling, and only engage vetted investors and evangelists alike via educational content as this approach is much warmer and far more strategic than cold outreach.

THE PROBLEM

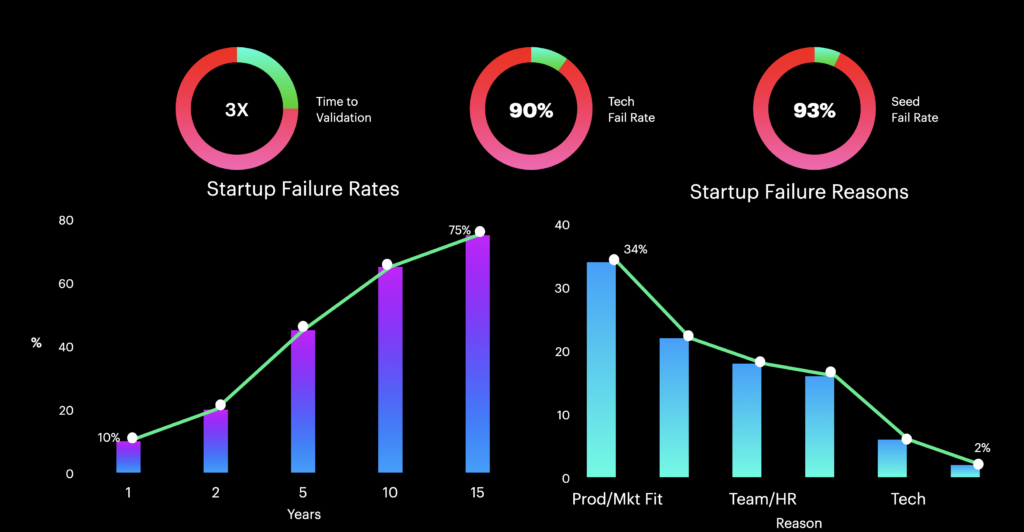

90% of all tech start-ups end in failure primarily due to not finding product-market fit. So, B.I.G.’s focus is on bridging legacy services with large evolving markets and SME technologist with vertical experience. The obvious reason is that SMEs gravitate to solving problems in large niche markets: commodities, supply-chain, equities, greentech, proptech, and AI/data automation in these fields – and others.

BIG ideas are great, but they need to be backed by great leaders capable of leading veteran teams to initial profitability. Thus, B.I.G. builds around leadership first and a complimentary set of service KPIs till a predefined exit scenario makes sense.

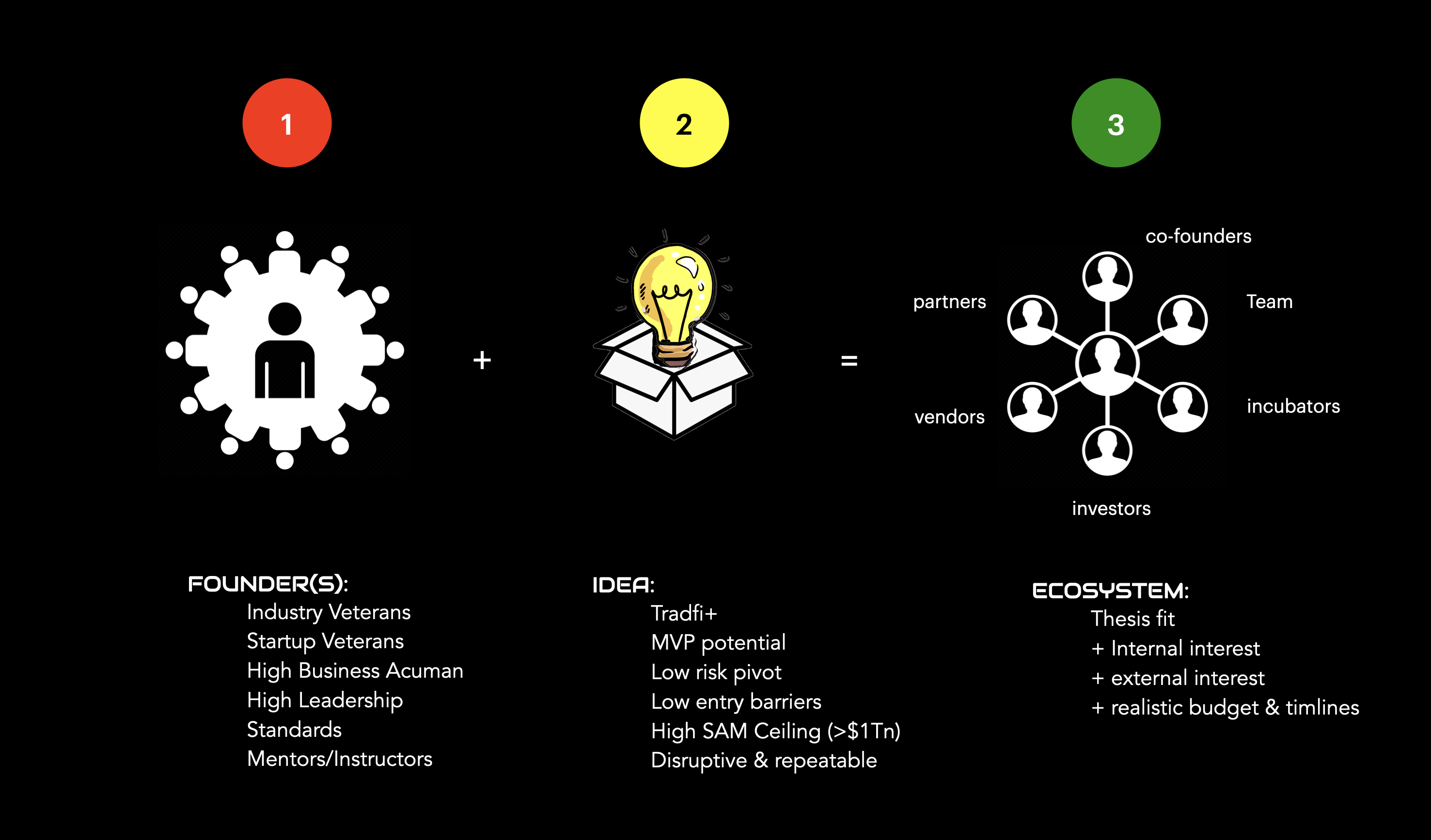

CRITERIA

We focus on legacy B2B products and services that require modernization or could use features to alleviate high pain issues. These services already compete successfully, but are ripe for disruption. These are markets searching to automate existing services (and/or) replace them. Our involvement criteria is very detailed and can be found on our Thesis page here.

PROJECTS

Each B.I.G. project has a six month KPI driven go-no-go period with a very limited number of founders and investors with a history of success in the target vertical. When it comes to capital sourcing we believe less people in the room brings better outcomes for our founders long-term.

The incubation stage is followed by a six month accelerator, so the business still has time to build and pivot – most likely with Gen AI augmentation (if it doesn’t already have it). At the one year mark, we should have enough data to either proceed or end our involvement.

SUMMARY

As long-term investors in the technology ecosystem – B.I.G. is a more ambitious version of existing incubators, accelerators, or thesis-driven technology investors. Our business is laser focused on an SME leadership model serving BIG inflection point ready markets. As we partner with vetted founders, we also partner with vetted VCs, angels, corporate funds, and LPs that have both a history in the field and clear entrance and exit strategies.

The product-market fit problem is solvable by sourcing and mentoring a founder type that we call “servant leaders”. These are men and women with vast niche experience (i.e. potential) that do not have the tools or time to build a team or investment network from scratch.

The potential for future success can be found not just in an idea, a data room, a network of people, or even technology – but down to those few brave men and women fighting the odds to become great entrepreneurs.